MIT and other institutions to serve as foundation of a new innovation structure.

This story first appeared in the Times of India.

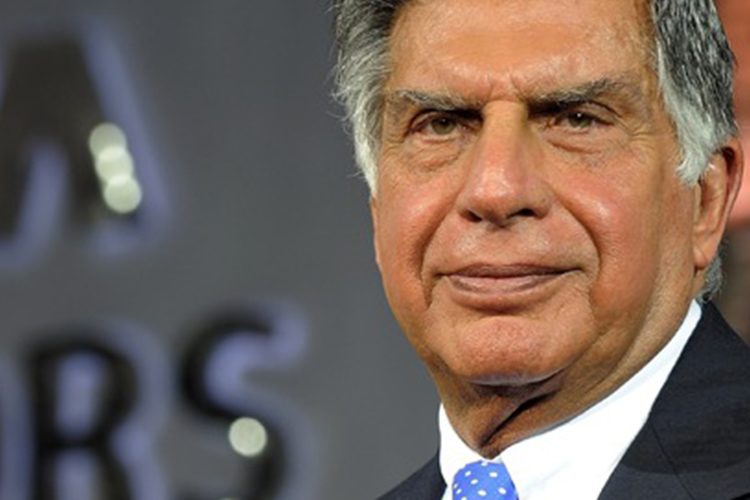

NEW DELHI: Ratan Tata, who has championed local startups through his personal investment vehicle RNT Associates, is keen that the Tata Trusts, a group of charitable institutions that own 66% of Tata Sons, evolve a structure to extend funding for social enterprises, which they can currently support only with grants.

The Tata Trusts are setting up a three-tier structure to fund socially relevant businesses that would mirror the Tata Group’s incubation of ventures at Tata Industries before they receive support from Tata Sons and eventually attract a diversified pool of investors.

“I have Mr Tata’s support to set up a new fund that will straddle the middle path between philanthropy and venture capital. The fund will sit outside the Tata Trusts’ architecture but will invest in socially relevant and viable businesses incubated within the trust,” said Manoj Kumar, head of innovation at the Tata Trusts.

The fund will use innovation centres of the Tata Trusts housed in the Indian Institute of Science, Indian Institute of Technology and Massachusetts Institute of Technology as the first layer in the structure to incubate socially relevant business ideas through grants provided to these institutions.

Businesses that demonstrate the ability to scale up will then get transferred to the Foundation for Innovation and Social Entrepreneurship (FISE), a vehicle set up under Kumar’s leadership last year. This will act as the second layer of the structure where the enterprises get accelerated.

The fund, an external vehicle, will form the third tier in the structure where enterprises with maximum potential for social change will be connected to an investor eco-system being set up externally by the trusts.

“The trusts can only give grants and cannot make an equity investment due to the guidelines laid out in the charters of the respective trusts. Through this vehicle, we can take equity in startups that find it difficult to raise funds because of their social sector status,” Kumar said.

The Tata Trusts have traditionally provided grants to educational institutions and to individuals and non-profit organisations involved in socially useful work in some of its priority areas. They have helped set up and administer cancer treatment facilities such as the Tata Memorial Hospital in Mumbai and the Tata Medical Centre in Kolkata.

The trusts collectively spent about Rs 800 crore in the form of grants in the financial year ended March 2016. More than two-thirds of the grants were in the areas of health, education and natural resource management and livelihood.

“Almost 40% of the work we are supporting across our various priority areas results in innovation. The new funding architecture will ensure that apart from routing spends through grants to non-profits, we are also promoting enterprises that are socially relevant and commercially viable by linking them to an investor eco-system,” Kumar said.

The fund will look at investing in social enterprises in agri-tech, healthcare and waste management.

Aformal application for setting up the vehicle is under consideration of the Securities & Exchange Board of India, the capital markets regulator.

Once approved, Kumar will approach international philanthropists to create a diversified pool of investors to back the fund. Hasiru Dala (Green Army), a Bengaluru-based organisation of rag-pickers funded by FISE, is raising a fresh round from the University of California, San Diego. Kumar described this as one instance of how the funding architecture would work, putting to use the Tata Trusts’ networks with investors and institutions. Tata Trusts recently announced a partnership with the Department of Science & Technology and aerospace and defence giant Lockheed Martin to provide funding to social enterprises. Tata Trusts is an umbrella organisation that represents an agglomeration of charitable institutions set up by the founders of the Tata Group.